Alex Saab proposes import substitution and boosting exports

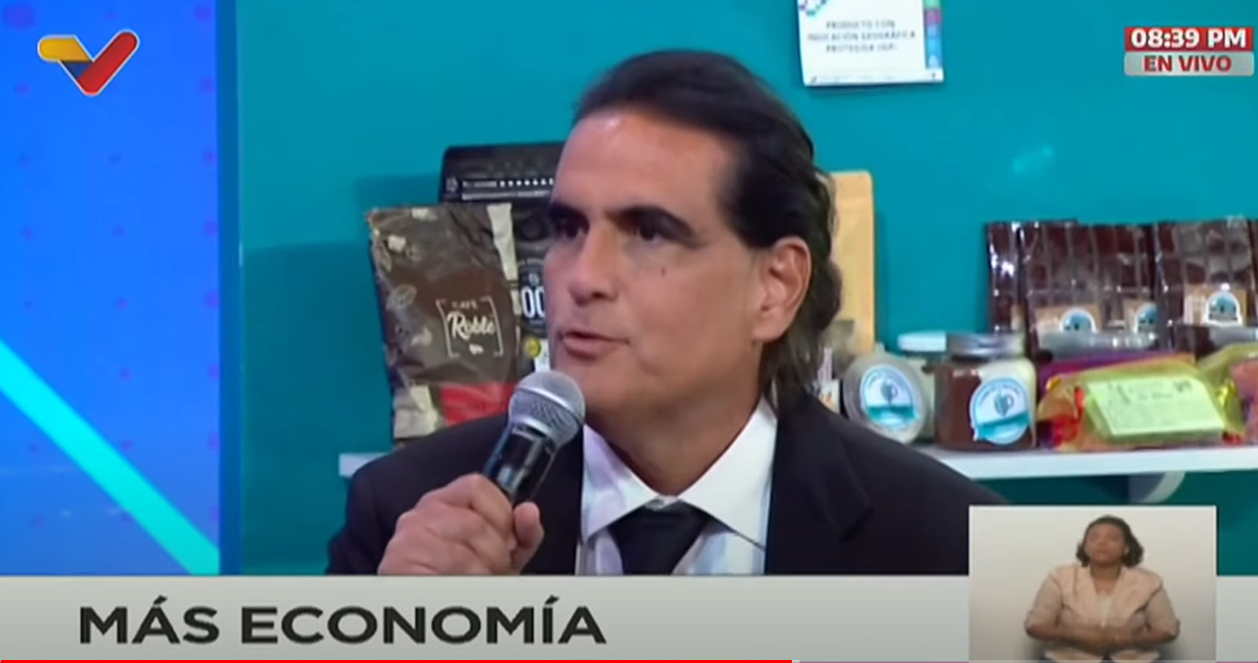

Alex Saab, Venezuela’s new Minister of Industry and National Production, speaks at the weekly presidential TV programme, Con Maduro +.

On 28 October, Minister of Industry Alex Saab said that Venezuela should pursue a policy of import substitution, and also aim to be a leading exporter in the region.

Speaking at President Nicolás Maduro’s weekly programme, Con Maduro +, Saab said “We are importing $8 billion worth of goods in the non-oil sector, and many of them are exempt from taxes. Our private and public industry can supply this market.”

The minister followed on to say “We have the market, and we must fill it with our own industries. This will strengthen our economy and prevent the outflow of hard currency for imports, which can then be used in social programmes, infrastructure, and other areas.”

Coninudstria, a business association, says that Venezuela’s private industry is using up just 39% of its installed capacity—considering the second quarter of 2024. In neighbouring Colombia, they use 73% and in Brazil, 79%.

Saab was appointed as Minister of Industry on 18 October. Last week, he said that Maduro instructed him “not to reduce bureaucracy, but to eliminate it.” He also foresees the national economy to grow by 8% this year.

The IMF is forecasting Venezuela’s growth to be 3% this year, while the UN Development Programme says 6.1%. The BCV, the central bank, said the economy grew by 8.8% in the second quarter.

The economy’s “bottlenecks”

Vice President Delcy Rodríguez, who also oversees the economy-related ministries, said that the main bottlenecks are bad public services and scarce foreign exchange reserves. Rodríguez said this is a symptom of fast growth, as the supply of hard currency, running water, electricity and fuel are lagging behind demand.

The Venezuelan government had tried to effectively freeze the exchange rate near VES 36 to the dollar through central bank interventions. However, the black-market rate has been climbing above that throughout the year, reaching close to VES 50 to the dollar on 29 October.

The official exchange rate has started to move this month, reaching VES 41 to the dollar on the same date.

Credit and other forms of raising capital are also scarce. Venezuelan banks’ credit portfolio is the smallest in Latin America—even than in Nicaragua, El Salvador or Paraguay, which have a much smaller economy.

After the 28 July election, where the opposition claims to have evidence of fraud, Maduro has reshuffled his cabinet, the military command, as well as various state-owned companies and other institutions.

On 20 September, Maduro replaced the foreign trade agency with a new one, and ordered an intervention of Bolipuertos, the port company, to crack down on corruption and bureaucracy.

From imprisonment in Florida to the national cabinet

Alex Saab was appointed to Industry to replace Pedro Rafael Tellechea, who had just been removed as Minister of Oil and PDVSA President in late August. On 20 October, Tellechea was arrested, accused of selling strategic information to US intelligence services while he was in charge of the oil industry.

Saab, a Colombian and Venezuelan dual citizen, spent two years imprisoned in Florida. He was en route to Iran to buy imports for Venezuela in 2020, when he was arrested in Cape Verde during a fuel stop. He was extradited in 2021 to the US on eight money laundering charges.

In December 2023, he was released and sent back to Venezuela as part of a prisoner swap. In Caracas, Saab was received like a hero by the Maduro government, and was soon appointed to head the CIIP, the state’s investment agency.

Now that Saab is in charge of both Industry and the CIIP, many expect foreign investment processes to speed up. Projects that arrive via the centre must pass through the relevant ministry as well.

Attracting foreign investment in extractive industries—oil, gas, and mining—has been comparatively easy, but beyond there are few success stories. Venezuela has one of the highest country risk ratings, with a bad reputation for its rule of law and property rights.

Despite efforts, the government has not managed to offset the high risk. For example, as it set up special economic zones in 2023, it was decided that the state would offer tax reimbursements instead of exemptions, as business groups recommended. Consequently, no investments have materialised within this framework to date.